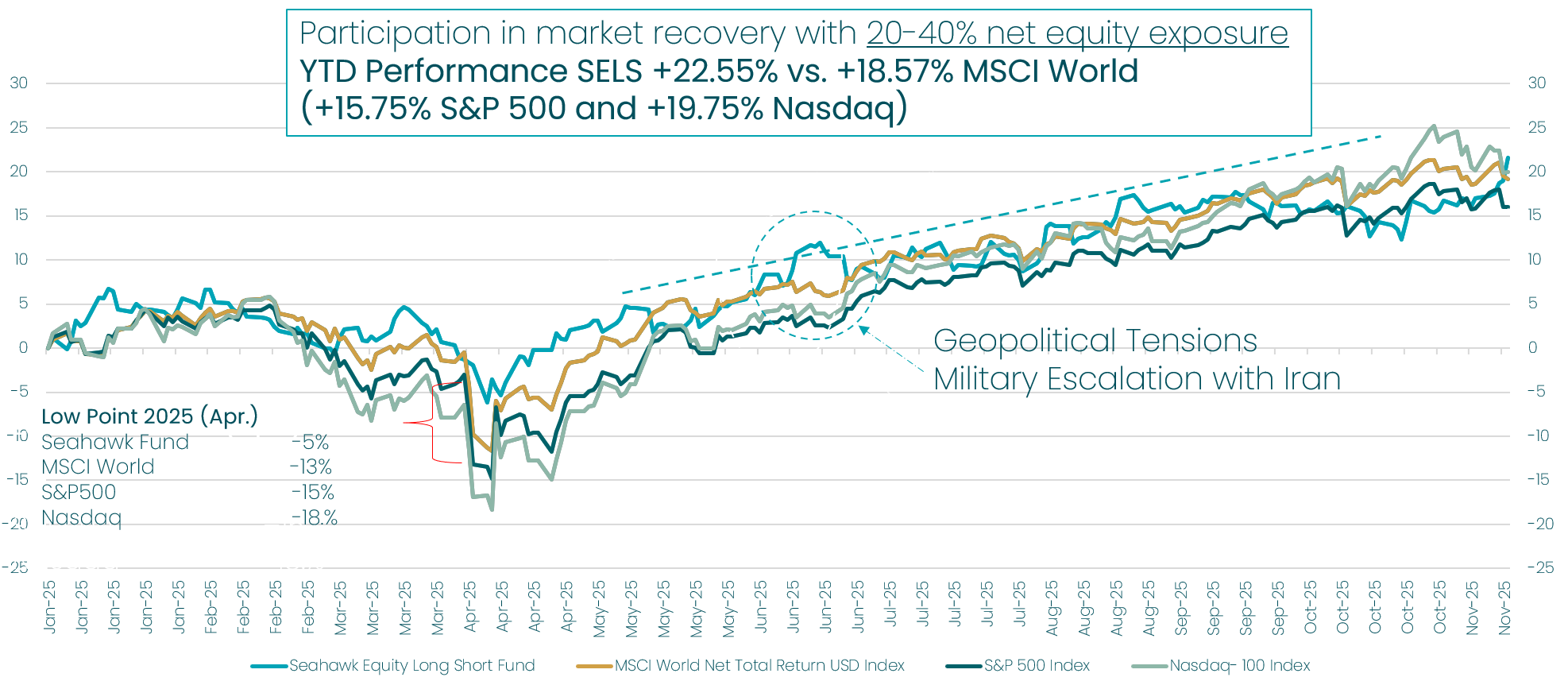

Strong Outperformance Compared to Global Benchmarks

The sector-focused Long-Short strategy of the Seahawk Equity Long-Short Fund has demonstrated remarkable strength this year in an environment shaped by geopolitical tensions, weak momentum in the transportation and energy sectors, and widespread market volatility. With a performance of +22.55% (USD share class, YTD as of November 17, 2025), the fund outperforms both global benchmarks – MSCI World (+18.57%), S&P 500 (+15.75%), and Nasdaq 100 (+19.75%) – as well as its own cyclical focus sectors. This performance highlights the suitability of the strategy as a diversifying component beyond traditional equity exposures.

Source: Bloomberg, 17.11.2025

Limited Losses in Stress Month of April

During the market stress in April, triggered by the tariff war initiated by the United States, the fund exhibited significantly lower vulnerability: while global indices fell between -13% and -18%, the fund’s decline was limited to just -5%. Despite a cautious net positioning of 20–40%, the portfolio subsequently participated nearly fully in the market recovery.

Specialized Strategy Proves Resilient Despite Weakness in Transportation and Energy

The transportation and energy markets, key areas of focus for the fund, experienced declines of up to -20% in 2025. Nevertheless, the fund maintained a clearly more stable profile. The sectoral expertise, combined with both long and short positions, allowed the fund to exploit inefficiencies in these niches while keeping the correlation to broad markets low.

“The significant double-digit losses across large parts of the transportation and energy sectors this year highlight the importance of a selective approach. Our fundamental analysis allows us to distinguish clearly between short-term market reactions and true structural trends.” Hubertus Clausius, MBA, CFA

Source: Seahawk Investments GmbH, 17.11.2025

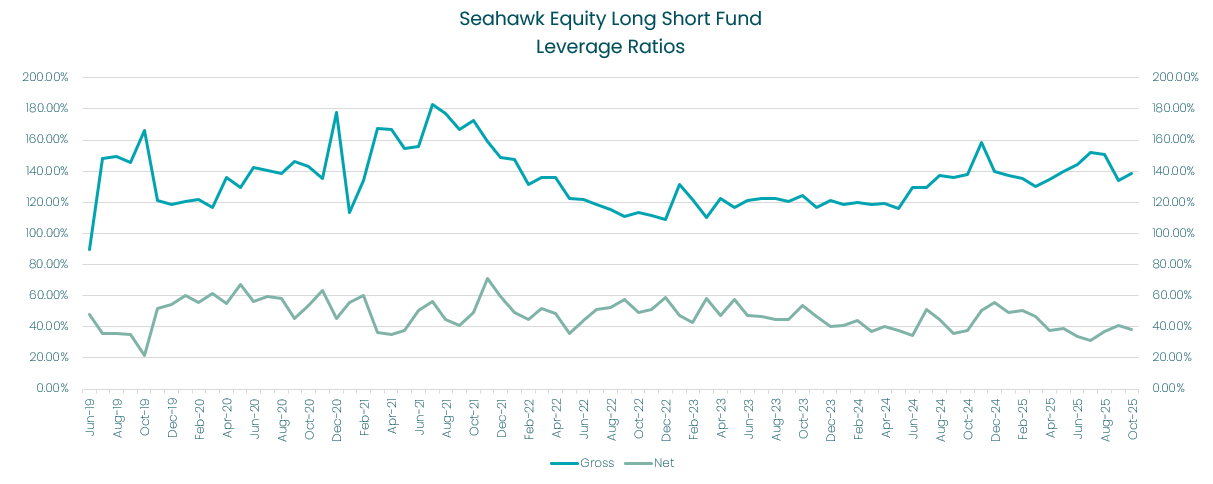

Flexible Leverage Management Stabilizes the Profile

The fund’s leverage history shows disciplined risk management: gross exposures between 120% and 160%, and an average net exposure of around 40%, help cushion drawdowns and effectively capitalize on recovery phases. Leverage management serves as a key lever to exploit sector-specific opportunities without disproportionately increasing the overall portfolio risk.

Top-Ranked Strategy in Peer Group Comparison

The peer group evaluation of the USD share class shows a 12-month performance of +21.79%. Over this period, as well as in the long-term five-year comparison, the strategy remains among the top-performing global long/short equity funds. These results confirm the strength of the focused approach in niche markets and the consistency in the risk-return profile.

Disclaimer

This document is a customer information (“CI”) in the sense of the German Securities Trading Act (WpHG). Responsible as the author for the content is the tied agent listed below. This “CI” is used exclusively for information purposes and cannot replace an individual, suitable investment advice. This “CI” does not constitute a contract or any other obligation or kind of contractual offer. Furthermore, the content does not constitute investment advice, an individual investment recommendation, an invitation to subscribe for securities or a declaration of consent, or a solicitation of an agreement on a transaction in financial instruments.

This “CI” is intended only for professional customers and eligible counterparties with a habitual residence or domicile in the EU and has not been written with the intention of giving legal or tax advice. The tax treatment of transactions is dependent on the personal circumstances of the respective customer and may be subject to future changes.

Recommendations and forecasts are non-binding estimates of future events. They can therefore prove to be inaccurate regarding the future development of a product. The information contained in this document is based exclusively on the date on which this “CI” was provided. A guarantee for the actuality and correctness cannot be given. Past performance is not a reliable indicator of future performance.

This information is protected by copyright; no reproduction or commercial use is permitted. Date: October 31st, 2025.

Author/Issuer: Hubertus Clausius, Seahawk Investments GmbH, Bettinastrasse 62, 60325 Frankfurt am Main, Germany. Investment advice according to section 2 para. 2 no. 4 German Wertpapierinstitutsgesetz (WpIG).

Seahawk Investments GmbH is authorized to provide financial portfolio management, investment advisory services, as well as investment mediation and contract brokering in accordance with Section 15 Paragraph 1 in conjunction with Section 2 Paragraph 2 Nos. 3, 4, 5, and 9 of the WpIG (Securities Institutions Act) and is subject to supervision by the Federal Financial Supervisory Authority (BaFin). Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) Marie-Curie-Straße 24-28, D-60439 Frankfurt am Main.