From USD 18 to 40 Billion

The Nordic High-Yield (NHY) market has experienced a strong growth surge since 2019: the market value has risen from around USD 18 billion to roughly USD 40 billion – an increase of about 120%. Over the same period, the more established High Yield markets expanded at a much more moderate pace (European High Yield: +48%, US High Yield: +24%). At the same time, the investor base has shifted: the share of Northern European investors declined from 59% (2022) to 32%, while UK and US investors together increased their share to 43%.

“What was long considered a regional niche has developed into a liquid, internationally sought-after submarket with robust primary market dynamics.” Benedikt Schröder, Senior Portfolio Manager, Seahawk Investments

Structural Advantages as a Catalyst

One driver of this market maturity is the streamlined new issuance framework: new issues do not require an official rating; the documentation is significantly more compact at around 200 pages compared to a typical US-prospectus (~600 pages). Issuances often take place under Norwegian law with medium-sized volumes starting at about USD 50 million – a setup that enables swift placements and access to underserved tranches.

“The Nordic bond framework is efficient: lower barriers, clear documentation, short time to market – ideal conditions for capturing premiums in smaller, less standardized tranches.” – Benedikt Schröder

Floating Rates as an Interest Rate Cushion, Higher Coupons as Return Drivers

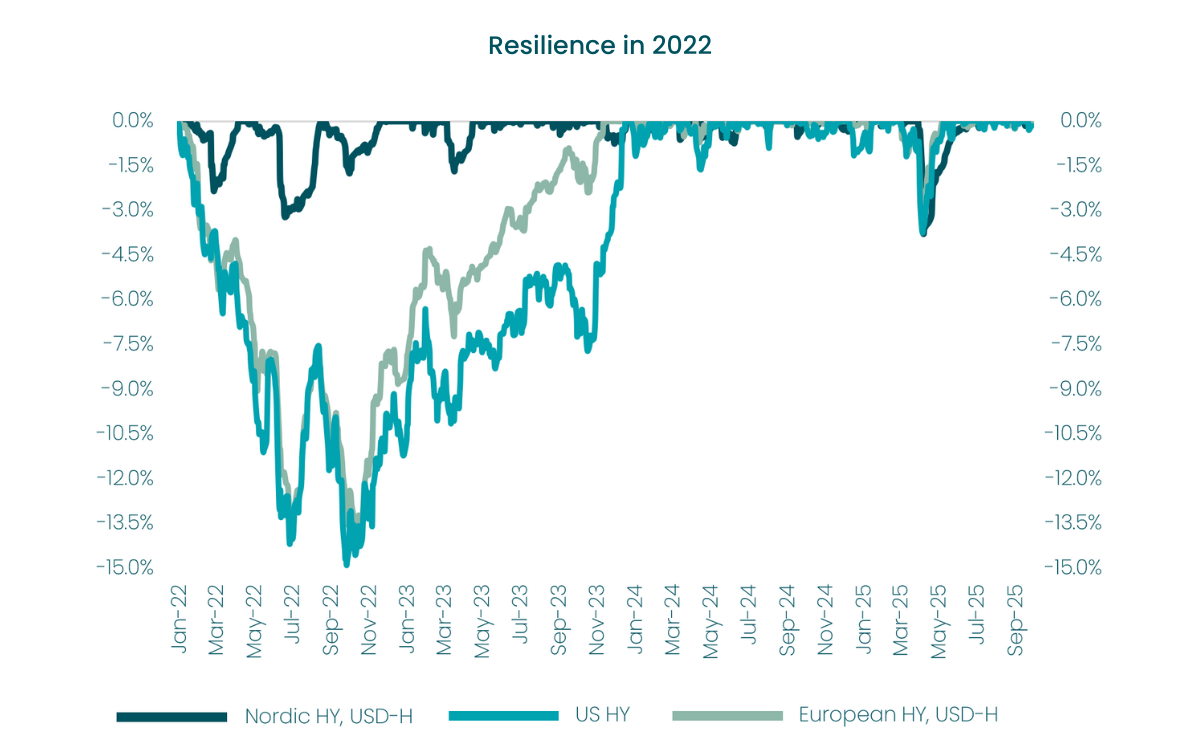

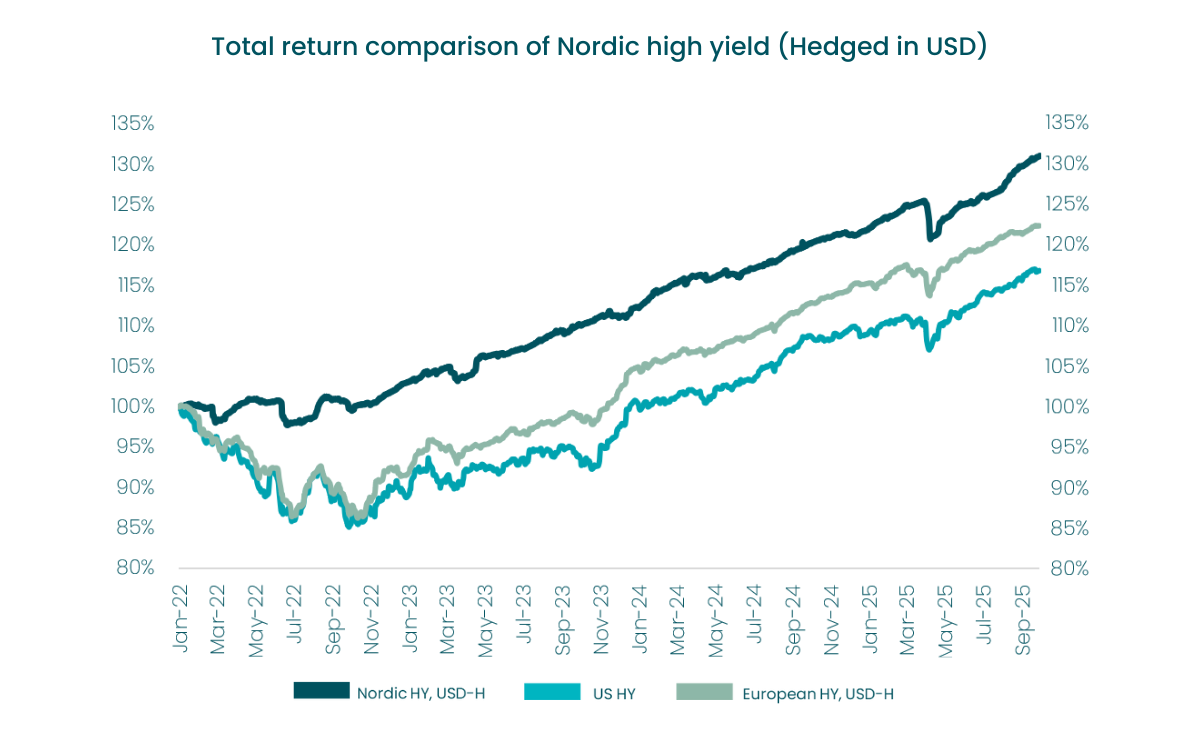

In the challenging bond year 2022, NHY demonstrated remarkable resilience: as of September 29, 2022, US High Yield reached a low of -14.9%, while the drawdown of NHY was only -1.5% – an outperformance of around 14.7 percentage points. The main reason is the high share of floating-rate notes (60–70%) and the correspondingly low interest-rate duration (~0.93% vs. ~4.4% in US High Yield). In addition, Nordic High Yield bonds offer, on average, higher coupons (~8%) and a spread premium of roughly +150 Bp compared to US High Yield.

Source: Bllomberg; 30.09.2025

Broader Sector Base – Opportunities in Energy, Transport, and Offshore

As the market volume expanded, heterogeneity increased: the share of oil & gas dropped from 64% (2009) to below 20%, while transport and energy infrastructure gained importance. For specialized, actively managed portfolios, this creates a diversified universe – from offshore services and shipping to transmission and distribution operators – with pronounced idiosyncratic spread drivers. The combined share of oil & gas, transport, and energy currently stands at about one-third – offering attractive investment opportunities in Seahawk’s focus sectors.

Primary Market: High Activity, Clear New Issue Premiums

The Nordic primary market continues to set records; placements are often well covered by books and, particularly for debut issuers, offer noticeable new-issue premiums. Liquidity in the secondary market depends on issue size but is compensated by a higher liquidity premium – an additional return component for selective buyers.

Source: Bllomberg; 30.09.2025

Strategic Positioning

Within a benchmark-free, sector-focused credit approach, Nordic High Yield serves as a component offering short duration, above-average carry, and recurring primary market opportunities.

In the October report, the Seahawk Credit Opportunities Fund reported an investment quota of 107%, an effective duration of 2.3%, and a market-weighted coupon of 8.2% for the overall portfolio. The focus included shipping (24%) and oil services (20%); Europe accounted for 55% of the geographic allocation. Selective participation in Nordic primary market transactions – such as Navios Maritime – was noted. The Nordic High Yield segment currently represents 37% of the portfolio and is one of its key focus areas.

Our complete Quarterly Note can be found at the following link: Quarterly Note 3

Disclaimer

This document is a customer information (“CI”) in the sense of the German Securities Trading Act (WpHG). Responsible as the author for the content is the tied agent listed below. This “CI” is used exclusively for information purposes and cannot replace an individual, suitable investment advice. This “CI” does not constitute a contract or any other obligation or kind of contractual offer. Furthermore, the content does not constitute investment advice, an individual investment recommendation, an invitation to subscribe for securities or a declaration of consent, or a solicitation of an agreement on a transaction in financial instruments.

This “CI” is intended only for professional customers and eligible counterparties with a habitual residence or domicile in the EU and has not been written with the intention of giving legal or tax advice. The tax treatment of transactions is dependent on the personal circumstances of the respective customer and may be subject to future changes.

Recommendations and forecasts are non-binding estimates of future events. They can therefore prove to be inaccurate regarding the future development of a product. The information contained in this document is based exclusively on the date on which this “CI” was provided. A guarantee for the actuality and correctness cannot be given. Past performance is not a reliable indicator of future performance.

This information is protected by copyright; no reproduction or commercial use is permitted. Date: October 31st, 2025.

Author/Issuer: Hubertus Clausius, Seahawk Investments GmbH, Bettinastrasse 62, 60325 Frankfurt am Main, Germany. Investment advice according to section 2 para. 2 no. 4 German Wertpapierinstitutsgesetz (WpIG).

Seahawk Investments GmbH is authorized to provide financial portfolio management, investment advisory services, as well as investment mediation and contract brokering in accordance with Section 15 Paragraph 1 in conjunction with Section 2 Paragraph 2 Nos. 3, 4, 5, and 9 of the WpIG (Securities Institutions Act) and is subject to supervision by the Federal Financial Supervisory Authority (BaFin). Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) Marie-Curie-Straße 24-28, D-60439 Frankfurt am Main.